Cash on Delivery (COD) feels like the safest option when you are a new Shopify merchant. You think, “If people can pay later, more people will order.” That part is true, but COD also creates a second problem:

Many orders never turn into money.

A Federal Reserve Bank of Atlanta report puts cash at only 14% of payments when it comes to customer payment choice.

So when you offer cash on delivery, it usually isn’t required. It’s more like a conversion safety net for a specific audience. And if you do it without rules, it can quietly break your margins.

This blog explains why COD fails in real merchant operations. It also explains the best cash-on-delivery alternatives in 2026 that you should adopt.

How does cash on delivery work for sellers?

On Shopify, COD sits under manual payment methods. Shopify marks those orders as unpaid until you receive the money and manually mark the order paid.

In the US, especially, COD typically works in two ways:

- You either collect payment yourself for local delivery.

- You use a carrier service (UPS, for example ) that collects payment at delivery and remits it later.

Here, delay is a major problem. You ship the product before you have the money, and you carry the risk if the customer refuses.

Cash on delivery doesn't always mean cash on hand.

Types of cash on delivery for Shopify merchants

Cash (classic COD)

The driver collects physical cash when the package arrives. You then receive that money later.

This option creates the most hassle because you deal with change, counting errors, and the chance of the customer not being home.

Credit/debit cards at the door

The delivery person carries a mobile card machine (a small POS terminal). Your customer uses their card right at delivery, just like paying at a store.

This reduces cash handling, but you still face issues like failed deliveries.

Mobile payments at the door

Instead of handing cash, the customer pays using a phone or contactless card. This often works through the same POS device.

It feels smoother for the customer, but it still depends on signal, device battery, and the customer actually being available.

Checks

The customer writes a check at the door and gives it to the driver. The big risk is that the check can bounce or get disputed, and you only find out later.

Payment through invoicing

You send a payment link by SMS or email, and the customer pays instantly before the driver hands over the package.

Before we get into why cash on delivery fails in 2026, let’s go through a few benefits of COD.

Pros of cash on delivery

It helps people trust your new store

Customers don’t want to enter card details at a new store, so COD makes them feel safer. It increases orders from first-time buyers.

It works well for local delivery businesses

If you deliver in your city, COD feels normal, like paying a pizza delivery driver.

It covers customers who don’t like digital payments

Some buyers prefer cash or don’t want to pay online, so COD keeps them as potential customers.

That being said, COD has more drawbacks than benefits.

Why does cash on delivery fail in 2026?

Order cancellation

COD orders have a lower “commitment level,” so customers cancel late or refuse delivery more often.

This is where your Shopify store’s profit disappears, because you already paid for shipping. Refusal to pay or cancelling orders still remains the top reason why store owners do not opt for COD.

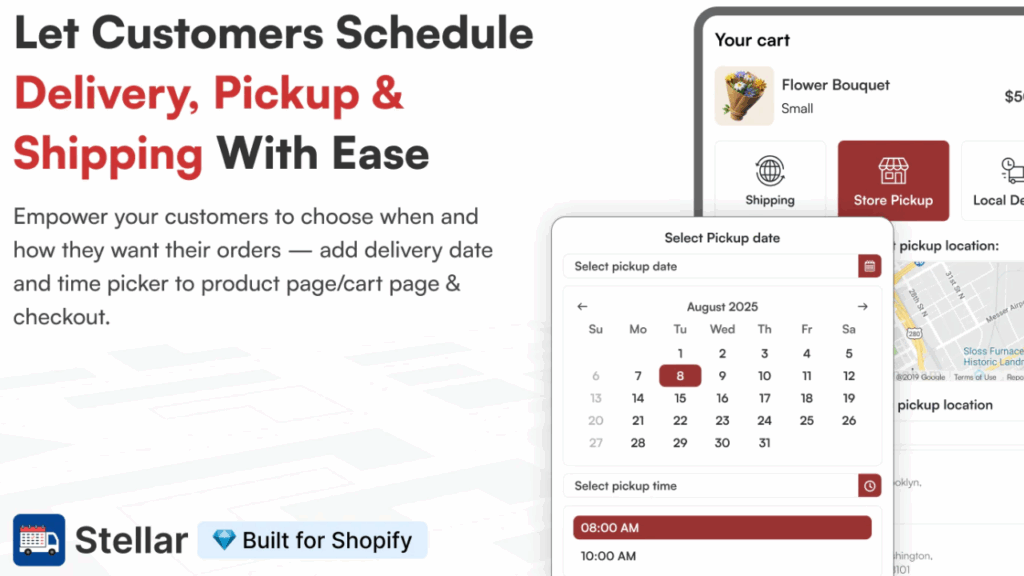

The Shopify app, Stellar Delivery Date & Pickup, directly reduces this by letting customers choose delivery date/time, showing estimated delivery timing, and even allowing rescheduling on the thank-you page.

More work for you

COD creates extra steps like confirmation calls and delivery coordination. Shopify also requires you to manage the “unpaid” state and update it after payment, which adds work for the admin.

Cash handling increases errors and risk

Any cash workflow comes with missed notes, wrong change, disputes, and confusion on “who collected what”

Even if nobody is dishonest, cash processes create more mistakes than digital logs.

Slower cashflow

With digital payments, you can manage your inventory around a fixed cash settlement time. With COD, your cash arrives later and less consistently. This makes it difficult to scale your store.

Harder to automate reporting

It's easier to track digital payments in Shopify with tools. On the other hand, tracking cash on delivery is done through spreadsheets, which are difficult to automate.

So why is there still cash on delivery as a payment option in 2026?

Why Shopify merchants still offer COD (despite its major cons)

Some merchants keep COD because of one simple reason: They fear losing conversions.

They look at checkout drop-off and assume COD is the fix.

In reality, many stores could win those customers with faster digital checkout and better trust signals.

Another reason is that many store owners bring cash on delivery as a payment option for regions where it is normal. But the current payment behavior is different, and cards plus wallets already lead most transactions.

The third reason is that cash on delivery looks good at first. The orders go up. But items do not get delivered, and merchants only notice after their return rate gets higher.

Alternatives to cash on delivery

Make digital checkout faster

Shop Pay is an accelerated checkout solution that is built to reduce friction. Every one in four Shopify customers has used Shop Pay to complete their transactions.

Offer BNPL (Buy Now Pay Later) services

Many shoppers choose COD because they do not like cash being deducted before receiving the order. BNPL gives them flexibility while keeping their order paid digitally.

Add a small COD fee or require a deposit

A small extra fee covers extra handling charges. This will also make the buyers choose digital methods to avail the discount.

Credit/debit cards (online or at delivery)

Let customers pay by card at checkout using Shopify Payments or a trusted gateway, so you get paid before you ship.

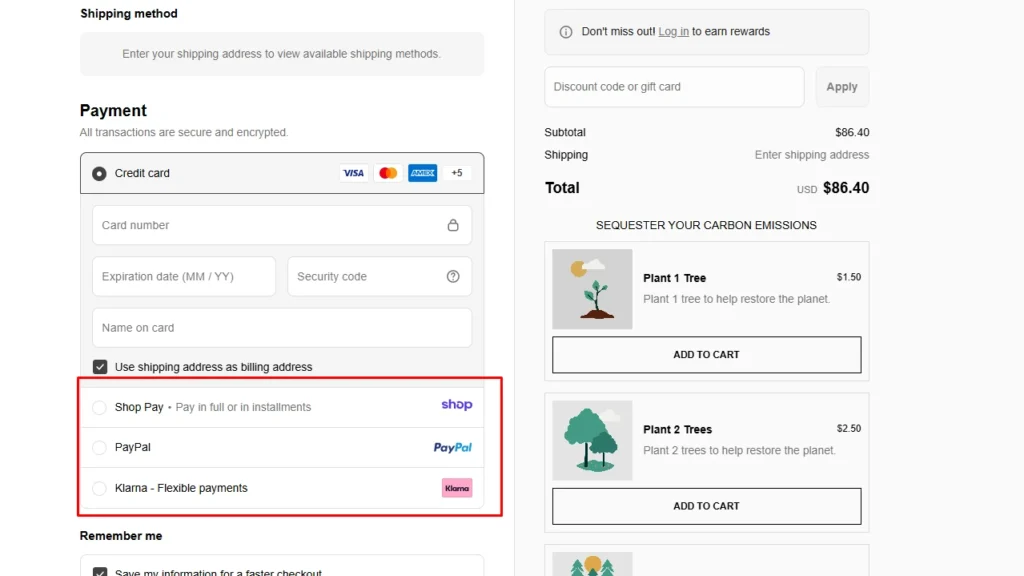

Offer the digital wallets

Add PayPal, Apple Pay, Shop Pay, or PayPal and then show their trust badges near the buy button and at checkout. This makes payment feel normal, not risky, for first-time buyers.

Source: Tentree's checkout page with multiple payment options.

Bank Transfers (internet banking)

Some B2B buyers and higher-ticket customers prefer paying by bank transfer. You send the customer an invoice with your bank details, and you ship only after the payment reflects in your account.

This option works best when you sell to businesses or wholesale, because it reduces payment fees and keeps the transaction clean.

Conclusion

For Shopify, COD is not the best option for payment. Most buyers already pay with cards and wallets, and cash keeps declining as a share of payments.

When I see COD fail for merchants, the pattern is always the same. Return rates rise, and cash flow slows down. If you want to increase your conversions in 2026, push digital payments first and keep COD as an option, with a little extra fee.

FAQs

1. Is cash on delivery safe for your sellers?

COD can work, but it carries more risk because you ship before you get paid. If the customer is not available or does not claim the product or return it, this can add extra cost for you.

2. Does Shopify support cash on delivery as a payment option?

Yes. Shopify supports COD as a manual payment method. Shopify marks these orders as unpaid or pending until you receive the money and manually mark the order as paid.

3. Why do cash-on-delivery orders get cancelled?

Many COD orders are cancelled late because the customer changes their mind, is not home, or refuses to pay at the door.

4. Cash on delivery vs digital payment. Which is better?

For most Shopify stores, digital payments are better because cards dominate. Faster digital checkout options like Shop Pay can also lift conversion compared to a typical checkout.

5. Why should you move to online payments from cash on delivery?

You get paid before you ship, so your cash flow stays stable, and you avoid many refusals and return costs. Online payments also give you better tracking in Shopify since COD orders stay pending until you manually confirm payment.

About the author

Vineet Nair

Vineet is an experienced content strategist with expertise in the ecommerce domain and a keen interest in Shopify. He aims to help Shopify merchants thrive in this competitive environment with technical solutions and thoughtfully structured content.