As an online business owner, optimizing the checkout process is essential to boosting conversions. One effective way to reduce cart abandonment and improve the shopping experience is by offering flexible payment options. In the debate of Shop Pay vs

Afterpay, both services allow customers to buy now and pay later through interest-free Installments. But which solution aligns best with your business goals and your customers’ preferences?

In 2025, the BNPL market is expected to reach $231.5 billion, driven by growing demand for flexible payment options, particularly among 59% of Gen Z and 58% of millennials in the U.S. have actively used buy now, pay later (BNPL) services, making them the dominant user groups driving this trend.

Let’s break down Afterpay vs. Shop Pay in simple terms, with no confusion, so that you can choose the best payment method for your customers and business.

What is Shop Pay? A Fast, Secure Payment Option for Shopify Shoppers

Shop Pay is a secure and convenient checkout solution created by Shopify. It’s designed to streamline the shopping experience by allowing customers to save their shipping and billing information for faster checkouts.

For businesses using Shopify, this means improved conversion rates and reduced cart abandonment. With its strong focus on security and ease of use, Shop Pay is legit and trusted by millions of users.

Is Shop Pay Safe?

The answer is a resounding yes! Shop Pay is built with industry-standard encryption and advanced fraud protection to ensure your checkout process is both safe and swift.

Shopify has designed it with your security in mind, giving you peace of mind with every purchase. So, when you shop with Shop Pay, you can be confident that your personal and payment information is fully protected.

What is Shop Pay Installments?

Shop Pay Installments is a Buy Now, Pay Later (BNPL) payment option offered by Shopify in partnership with Affirm. It allows customers to split their purchase into four interest-free payments or opt for monthly payments with interest (on higher order values), depending on the total order amount and eligibility.

How Does Shop Pay Work?

Now that you know the basics, let’s dive into how each of these services works in practice.

1. At Checkout: When a customer chooses Shop Pay at checkout, they are prompted to enter their email address associated with their Shop Pay account.

2. Verification: A 6-digit verification code is sent to the registered phone number or email address to confirm identity and protect the account.

3. Payment & Shipping Info Auto-Fill: Once verified, Shop Pay automatically fills in the customer's saved payment details, shipping address, and billing address, eliminating the need to re-enter this information.

4. Quick & Secure Payment: With just a few clicks, the order is completed, saving time and reducing friction in the checkout process. All information is securely encrypted and PCI-compliant.

5. Track Orders Easily: Customers can use the Shop app to track their orders in real time, receive delivery notifications, and manage returns seamlessly.

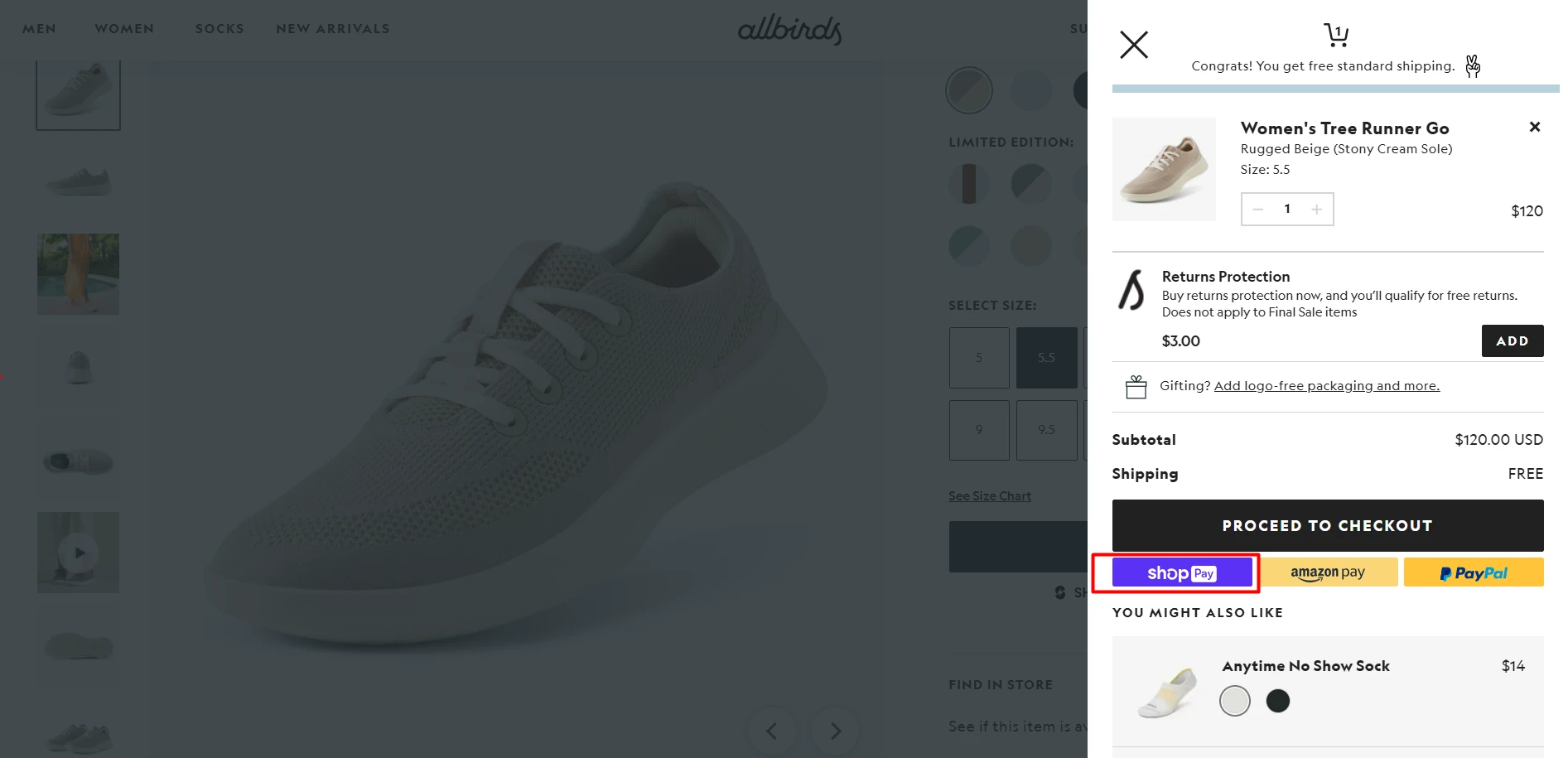

Checkout page with Shop Pay button

Note: Shop Pay is only available at stores that use Shopify and offer it as a payment method. If the store doesn’t support Shop Pay, you’ll need to enter your payment information manually at checkout.

Is Shop Pay secure?

Yes, Shop Pay is a secure payment method that ensures your data is protected. It utilizes encrypted servers and complies with PCI-DSS standards, ensuring a secure transaction for both customers and merchants.

Pros and Cons of Using Shop Pay

Pros:

- Fast checkout process with saved shipping and billing details.

- Option to split payments into four interest-free installments (Shop Pay Installments).

- Secure with fraud detection and order verification.

- Order tracking and delivery updates for customers.

- Seamless integration with Shopify for merchants.

- It can help increase conversion rates by reducing cart abandonment.

Cons:

- Only available on Shopify stores.

- Late payment penalties for missed Installments.

- Not available in all countries.

- Primarily works with credit and debit cards.

- It could encourage customers to overspend with instalment payments.

What is Afterpay? A Flexible BNPL Option for Global Shoppers

Afterpay is a Buy Now, Pay Later (BNPL) service that allows customers to purchase products immediately and pay for them later in four interest-free installments. It’s widely used by online and in-store retailers to offer shoppers a flexible, short-term payment option, without the need for credit cards or paying interest (if paid on time).

What is Afterpay Installments?

Afterpay Installments breaks your purchase into four equal payments spread over six weeks. The first payment is made at the time of sale, while the remaining three are automatically deducted every two weeks.

There’s no interest or fees as long as payments are made on time. Everything is managed through the Afterpay app or website, where users can track upcoming payments, reschedule if eligible, and receive reminders.

These short-term, structured payments provide a predictable and manageable way to budget for purchases, especially for everyday items or mid-range expenditures.

1. Shop Online or In-Store: Visit a retailer that supports Afterpay and add the items you want to your cart.

2. Select Afterpay at Checkout: Choose Afterpay as your payment method at checkout.

- New users: Sign up with basic details.

- Existing users: Log in to complete the purchase.

3. Get Instant Approval: Afterpay performs a quick eligibility check and provides instant approval, no hard credit check involved.

4. Pay in 4 Installments:

- Pay 25% of the total upfront at the time of purchase.

- The remaining balance is divided into three equal biweekly payments, which are automatically deducted from your chosen payment method.

5. Manage Payments via the App: Use the Afterpay app or website to:

- View payment schedule

- Get reminders

- Reschedule payments (if eligible)

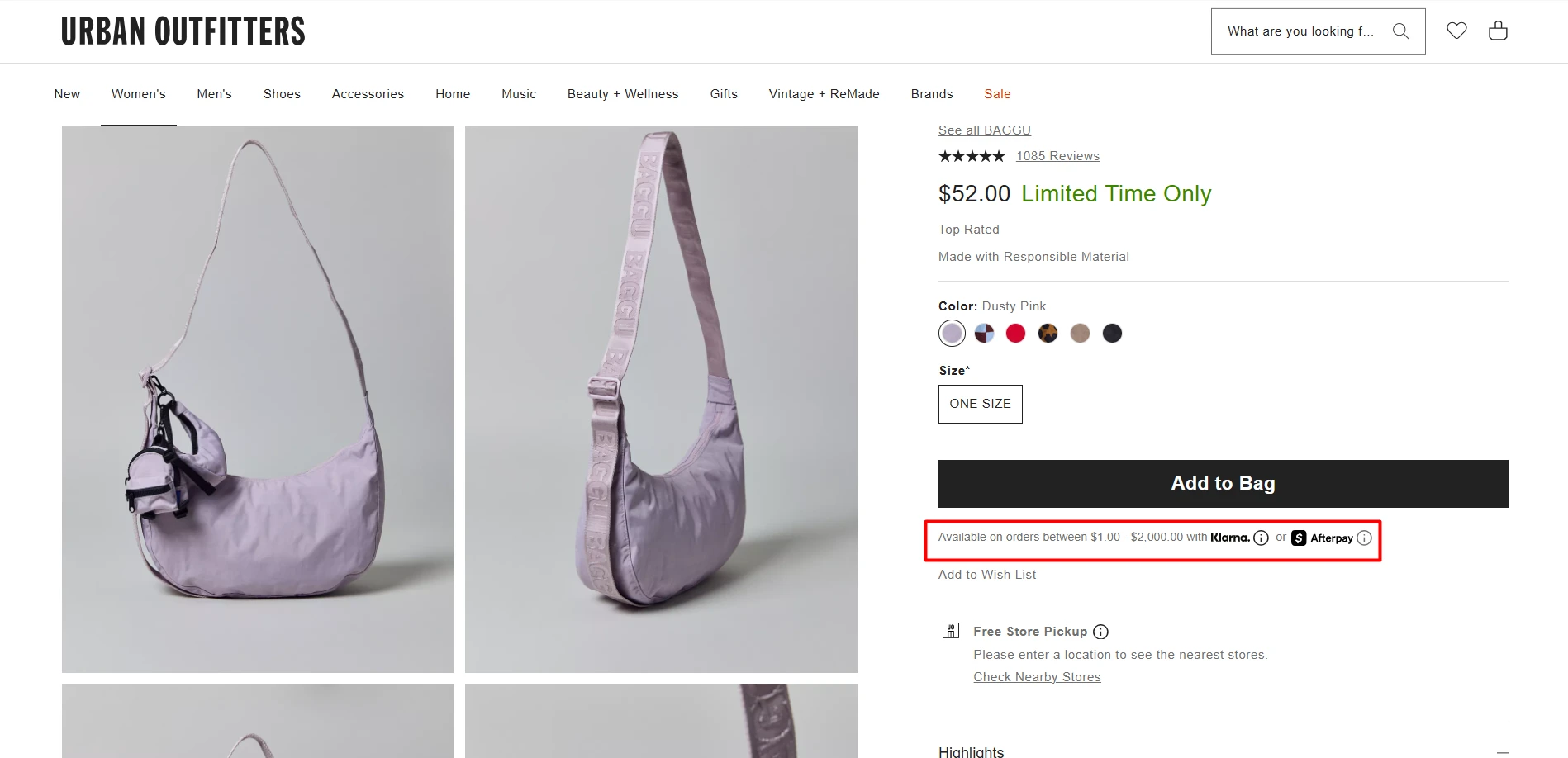

Afterpay option displays on the product page

Once you've activated Afterpay, your payment details will be saved securely, making it easy to use Afterpay for future purchases.

Before using Afterpay, please note that you must be at least 18 years old and have a valid debit or credit card on file. You might also need to complete a credit check. Afterpay may charge late fees if you miss a payment, so be sure to keep track of your payment schedule to avoid any additional fees.

Pros and Cons of Using After Pay

Pros:

- Interest-free payments are split into four installments.

- It is accepted by thousands of retailers, both online and offline.

- Flexible payment options over a few weeks.

- No credit check required for usage.

- Quick and easy setup with linked payment methods.

Cons:

- Late fees are charged if payments are not made on time.

- Available only in certain countries (US, UK, Canada, Australia).

- Requires a linked payment method for automatic deductions.

- It can encourage overspending by allowing deferred payments.

- Not available at every retailer.

Next, let's examine the key features of Shop Pay and Afterpay, two popular payment options that provide flexibility in making purchases.

Key Features Comparison: Shop Pay vs Afterpay

Here's a side-by-side comparison of the features of Shop Pay and Afterpay to help you make an informed decision:

| Feature | Shop Pay | Afterpay |

|---|---|---|

| Payment Structure | Four interest-free payments | Four interest-free payments |

| Availability | Available on Shopify stores | Available across multiple retailers worldwide |

| Late Fees | No late fees, but missed payments may affect credit | Late fees for missed payments |

| Credit Impact | Does not impact credit score if payments are on time | Does not impact credit score unless payments are missed |

| Security | Backed by Shopify, highly secure | Secure and trusted with encryption technology |

| Payment Method | Debit/Credit Cards, Shop Pay account | Debit/Credit Cards, Bank Account, PayPal |

| Global Availability | Primarily in North America | Available in US, UK, AU, and CA |

| Ease of Use | Fast checkout, Shopify integration | Widely accepted at many retail stores online |

| Eligibility | Available to anyone with a Shopify account | Available to those who meet Afterpay's eligibility criteria |

| Return Policy | Same as the store's return policy | Return policy is set by the retailer |

Is Shop Pay the Same as Afterpay?

Although Shop Pay and Afterpay share the same core concept, splitting payments into four installments, they are not the same. Shop Pay is integrated with the Shopify ecosystem, making it ideal for Shopify merchants and users who shop on Shopify-powered stores. In contrast, Afterpay is accepted at a variety of online and physical stores globally, offering customers more flexibility.

Both Shop Pay and Afterpay offer valuable benefits for consumers who want to break up their purchases into manageable payments. However, the right choice depends on where you shop and your specific needs.

Ready to Start Shopping with Flexible Payment Options?

Now that you know the differences between Shop Pay and Afterpay, it’s time to choose the option that suits your shopping habits. Whether you’re shopping on Shopify stores or looking for flexibility across various retailers, both services are designed to make your purchasing experience easier. Choose the one that works best for you and start enjoying the convenience of Buy Now, Pay Later today!

FAQs

1. Where can I use Shop Pay as a merchant?

You can use Shop Pay as a merchant on any Shopify-powered store. It's fully integrated into the Shopify platform, making it easy to offer a fast and secure checkout experience for your customers.

2. Is Shop Pay available internationally?

Shop Pay is available in select countries, including the U.S., Canada, and parts of Europe.

3. Are Shop Pay and Affirm the same?

No, Shop Pay is a checkout solution by Shopify, while Affirm is a separate financial tech company offering Buy Now, Pay Later services across various retailers.

4. Is Afterpay available internationally?

Yes, Afterpay is available in the U.S., Canada, the UK, and Australia.

5. Can I use Afterpay without a credit check?

Yes, Afterpay does not require a credit check to use its services.

6. Is Afterpay available at all retailers?

No, Afterpay is not available at every retailer, but it is accepted by thousands of online and physical stores.

7. Is Shop Pay Like Afterpay?

Yes, Shop Pay is similar to Afterpay in offering interest-free installments, but Shop Pay is mainly for Shopify stores, while Afterpay is accepted by more retailers.

About the author

Bhavesha Ghatode

Explore Content with Bhavesha, a passionate and dedicated technical content writer with a keen understanding of e-commerce trends. She is committed to sharing valuable insights, practical assets, and the latest trends that can help businesses thrive in a competitive environment.